Sunday, November 30, 2008

Phillipcapital Market

Summary:

1) US T-bills yield rates down, together with bond prices down implies that credit market is not good ( people would rather put their cash in safe places then invest other places like the stock market)

2) Recommends to buy commodities like Soy Beans ( because China is increasingly consuming more of these. And Corn ( as harvest is expected to be slowly this year, leading to a shortage of supply)

3) Recommends to buy Singapore and China government bonds, as these 2 countries have lots of reserves and their currency are not expected to drop over too much over the next few years.

Saturday, November 29, 2008

Great site for good deals in Singapore

This site contains lots of good deals for everyone out there, for example

- Automotive

- Books & Magazines

- Computers

- Dining!!

- Electronics

- Mobile Phones

- Finacial and Insurance

- And many many more!

Thursday, November 27, 2008

Mr Yeo's Trading system

I would like to thank Mr Yeo for his contribution to the blog.

Here is how he does it (as quoted by him) :

Basically this is my strategy. It is very similar to the stock trader, Jesse Livermore. Livermore shorted the market when it crashed in 1929.

1. Decide what stocks. I have a first line list and a standby list. Those in standby list are

Keppeland, Sembcorp Marine, Wilmar. Unless they drop to near $1 where risk is much

less, I may not consider buying. All the stocks belong to a different class. You cannot

expect a BMW to be in same class as a Toyota.

2. Then work out how much capital you are putting in.

3. Allocate how many lots for each of the stocks you wish to buy. After my first buy,I

won't buy more of a stock as it go down but buy less. I prefer to buy more when

I see my stock going up and I am in paper profit. But I cannot keep averaging up

and I have to stop at a certain price. So that chart may help me in that. But right now I

just estimate for each stock waht is the range I wish to average up.

4. With margin, I prefer to be in borrowing phase when I am in paper profit.This is

important. That's why I average up. Thus now that I nimble here and there, I buy bit by

bit.

Just don't put all your lots at one price. But first entry should be at a reasonable low risk level. There is no meaning buying a stock at $1 and then you still want to nimble all the way down to if it goes to 20c.

Wednesday, November 26, 2008

Citibank clear card

Tuesday, November 25, 2008

How the world is deleveraging itself

I read an article recently which gives an addition perspective on the current financial crisis.

It started in the bull market in around 2003

- Funds took in money from the common people

- Using this money as collateral ( something like mortgage) , they went to the Japan banks to borrow even more money, up to 30 times for investment. This is becaue Japan has a very low interest rate for borrowing money.

- Using this money they invested in many risky products

- Started with HSBC writing off $10 billion of sub prime mortgage and the fall of companies like Lehman Bros etc.

- This cause investors to lose confidence and pull out their cash from these funds.

- Hence, because the funds have to pay back these people, they are selling their bad investments at a loss ( their losses is up to 30 times what they invested, because of the leveraging they used in the bull market)

- And they are trying to minimize their leverage by trying to change their investment back to cash.

- This process is then what we call deleveraging.

- In the process, the funds have to return the $$ they borrowed from the Japan banks.

- Hence they have to buy the Yen, in order to return Yen to the bank

- This cause the Yen to strength significantly, which is what is happening at the moment.

Monday, November 24, 2008

Something interesting on how wall street works =)

Subject: Wall Street

If you have difficulty understanding the current world financial situation,

the following should help...

Once upon a time in a village in India, a man announced to the villagers

that he would buy monkeys for $10.

The villagers seeing there were many monkeys around, went out to the

forest andstarted catching them.

The man bought thousands at $10, but, asthe supply started to diminish,

the villagers stopped their efforts. The man further announced that he

would now buy at $20. This renewed the efforts of thevillagers and they

started catching monkeys again.

Soon the supply diminished even further and people started going back

to their farms. The offer rate increased to $25 and the supply of monkeys

became so little that it was an effort to even see a monkey, let alone

catch it!

The man now announced that he would buy monkeys at $50! However,

since he had to go to the city on some business, his assistant would

now act as buyer, on his behalf.

In the absence of the man, the assistant told the villagers: 'Look at all

these monkeys in the big cage that the man has collected. I will sell

them to you at $35 and when he returns from the city, you can sell

them back to him for $50.'

The villagers squeezed together their savings and bought all the

monkeys.

Then they never saw the man or his assistant again, only monkeys

everywhere! Welcome to WALL STREET.

Sunday, November 23, 2008

Government Package

The Singapore Government has came up with plans to help keep people employed and even those who are unemployed. This is because unemployment is expected to go up to 4.5% next year compared to the 2.2% this year.

Package includes

- 90% subsidy of training fees for blue collar workers and 80% subsidy of white collar workers ( This is to encourage companies to send their workers for training)

- Paying $6/hr for workers that are sent for training and $6.80/hr for older workers with less than A lvl ( This means that companies do not have to sack workers, instead they can send them for training and 'pay' them using this fund. So, even though the workers get paid lesser, at least they still have a job and are learning useful skills in preparation of the market recovery)

- Even for the jobless, they will pay $4/hr to low skilled people to attend training and up to $1000/mth to the higher skilled

There is also the $2.3 billion loan and credit facilities to help out companies by making 'funds' more readily available to companies to help them tie over this time of financial uncertainly.

Finally, more 'goodies' are expected on Jan 22, when the government will announce the new budget.

Saturday, November 22, 2008

Trading Team / Networking session

Date : 14th Dec 2008 (Sun)

Time: 2pm

Venue : Nanyang Technological University , Nanyang House

Directions to the place :

1) Take 179 from Boon Lay Interchange, and alight at the 3rd stop after entering NTU.

1) Take 179 from Boon Lay Interchange, and alight at the 3rd stop after entering NTU.( The red triangle right in the center of the map)

2) Cross the roads, heading towards the hill, and climb the stairs leading up it.

If you are interested, do drop me an email at ntuchartist@hotmail.com

please include the following in your email :

- Name

- Your handphone number

- Age

- Current job

- Risk profile

- Traded on the market before?

- Current portfolio of investments

- Any business ideas in mind

Always read the fine print !

Looking the advertisement by OCBC, the first impression is a really high interest rates of 2.68%p.a. But upon looking closer, it is only effective for 10 DAYS!! and for the rest of the 10months it is 1%. Making it effective 1.05 p.a.% which is really really low!

So as you can see, always read the fine print! Even though it is common sense thing to do, I believe many people still overlook the fine print, especially if it is really wordy.

Remember that your money is at stake, and the bank will always use the fine print against you!

Friday, November 21, 2008

PhillipCapital Market Watch 17-21 Nov

Summary

- Swings are really big in the US market, 200billion lost in 15min

- Fundamental Analysis does not work in such a market condition

- However look out for US consumer stocks ( big names in terms of branding) as they are the 2nd cheapest in terms of valuation as compared to the financial sector. Almost an 80% drop in price, though their expected drop in EPS ( earnings per share) is expected to be only 20-25%

Thursday, November 20, 2008

Arbitrage using gold leasing

I got the idea from The Straits Times on Sat, 25 Oct 2008, pg A22

The idea is like this

- You borrow gold from a bank at 2.5% interest ( used to be 0.25% before the credit crisis, and that is really low!)

- Sell the gold for USD ( Gold is priced in the world market in terms of USD)

- Take the USD and lend it out at the current 1 month USD short-term LIBOR interest rate 3.24% (as of 24 oct 08)

- At the end of 1 month, you pocket the the extra interest of 3.24%-2.5%=0.74%

- Change the USD back to gold

- Return the gold back to the bank

Things to take note for this to work!

- Interest rate of borrowing gold from bank

- Market price of selling gold for USD cash

- Short term USD cash loan's interest rate

- Future price of USD cash for gold

However if you happen to get lucky and come accross all the conditions, why not give it a try? It's really a risk free profit due to market inefficiency...if you don't make the profit, someones else will =)

Wednesday, November 19, 2008

Business & Marketing Logics.....Just for Laughs

BUSINESS LOGICS

Father: I want you to marry a girl of my choice

Son: 'I will choose my own bride!'

Father: 'But the girl is Bill Gates's daughter.'

Son: 'Well, in that case...ok'

Next Father approaches Bill Gates.

Father: 'I have a husband for your daughter.'

Bill Gates: 'But my daughter is too young to marry!'

Father: 'But this young man is a vice-president of the World Bank.'

Bill Gates: 'Ah, in that case...ok'

Finally Father goes to see the president of the World Bank.

Father: 'I have a young man to be recommended as a vice-president.'

President: 'But I already have more vice- presidents than I need!'

Father: 'But this young man is Bill Gates's son-in-law.'

President: 'Ah, in that case...ok'

This is how business is done!!

Moral: Even If you have nothing, You can get Anything. But your attitude should be positive

What is Marketing?

You see a gorgeous girl at a party.

You go up to her and say, 'I am very rich. Marry me!'

That's Direct Marketing

You're at a party with a bunch of friends a nd see a gorgeous girl.

One of your friends goes up to her and pointing at you says, 'He's very rich. Marry him.'

That's Advertising.

You see a gorgeous girl at a party.

You go up to her and get her telephone number.

The next day you call and say, 'Hi, I'm very rich. Marry me.'

That's Telemarketing.

You're at a party and see a gorgeous girl.

You get up and straighten your tie; you walk up to her and pour her a drink.

You open the door for her, pick up her bag after she drops it, offer her a ride, and then say, 'By the way, I'm very rich 'Will you marry me?'

That's Public Relations.

You're at a party and see a gorgeous girl.

She walks up to you and says, 'You are very rich, I want to marry you.'

That's Brand Recognition.

You see a gorgeous girl at a party.

You go up to her and say, 'I'm rich. Marry me'

She gives you a nice hard slap on your face.

That's Customer Feedback

Monday, November 17, 2008

Gambling or investing?

I. Gambling: (i) It is zero-sum which means "positive returns to the middleman (i.e. casino) translate to negative returns to the player". For example, the return to "4-D, Small" is - 42.0 per cent. It means that in the long-run, you will average a loss of 42 per cent per wager. It also means that for every $100 that is bet, Singapore Pools keeps $42. It pays out $58 to players in winnings.

(ii) The column “How long to lose it all” tells how many hours, tickets or races it takes to lose 95 per cent of your initial capital at a normal rate of play. In the example for 4-D, Small, it is "6 tickets". It means that on average, a person will lose 95 per cent of their initial capital after playing 6 tickets.

(iii) The odds for the games assume perfect play such as knowing when to take another card in blackjack. For horse-racing, it assumes average skills.

II. Derivatives: (i) Options, futures, warrants and structured warrants are the most common derivatives.

(ii) Derivatives are contracts and not assets. Because the contracts have limited lives, they are zero sum among all market participants. At any point in time, gains equal losses among all traders, before costs. Hence the name zero-sum. After costs, the sum of all trader returns is negative. This makes derivatives less like investing and more like gambling, which is also negative-sum.

(iii) It is not possible to estimate the size of the negative returns or "How long to lose it all" for two reasons: (a) trading costs (the numerator) vary for each type of derivative and (b) margin requirements (the denominator) vary from broker to broker.

III. Investing: (i) ILPs are “investment-linked products”. These are similar to unit trusts and sold by insurance companies. Both are called "funds". ETF’s are exchange-traded funds. They differ from other funds because they trade like stocks. In Singapore, they have much lower expenses than other funds.

(ii) Investment returns assume a diversified portfolio. Returns to stocks and small stock are from US data since 1926. Small stocks are defined as having a market capitalisation (price x no. of shares) under US$200 million.

(iii) Expected returns for funds (Unit Trusts and ILPs) are only 4.2 %. It is for various reasons -- (more than just high expense ratios).* This is taken from: http://www.askdrmoney.com/gambling_investing_odds.htm

Sunday, November 16, 2008

Update of the other blog

http://ThePowertoTrade.blogspot.com/

Saturday, November 15, 2008

Arbitrage

Arbitrage is something that was introduced to me by a friend in the business faculty this year. I found the idea very intriguing as it provides an opportunity to get a risk free profit.

The idea behind this is to make use of market inefficiencies, and is usually applied in financial instruments such as bonds, stocks, derivatives, commodities , currencies etc.

A simple example would be:

Exchange rate in London are £5 = USD10 = ¥1000

and the exchange rates in Tokyo are ¥1000 = USD12 = £6

So with £5 in London, you change to ¥1000 and using this ¥1000, you go to Tokyo and change it back to £6. An instant profit of £1 !

This is 'triangle arbitrage'. Though this example is so simple that it does not occur, but it serves as in illustration of market inefficiencies where you can take the chance to make a risk free profit.

I shall give a few more actual examples that are happening in my future posts. It is good to know about this, because it is really a simple way to make a quick risk free profit. The most difficult part I feel, is to actually find such opportunities, as they are usual rare and do not last long.

Wikipedia link : http://en.wikipedia.org/wiki/Arbitrage

Friday, November 14, 2008

Interesting Financial acronym =)

CEO --Chief Embezzlement Officer.

CFO -- Corporate Fraud Officer.

BULL MARKET -- A random market movement causing an investor to mistake himself for a financial genius.

BEAR MARKET -- A 6 to 18 month period when the kids get no allowance, the wife gets no jewelry, and the husband gets no sex.

VALUE INVESTING -- The art of buying low and selling lower.

P/E RATIO -- The percentage of investors wetting their pants as the market keeps crashing.

BROKER -- What my broker has made me.

STANDARD & POOR -- Your life in a nutshell.

STOCK ANALYST -- Idiot who just downgraded your stock

STOCK SPLIT -- When your ex-wife and her lawyer split your assets equally between themselves.

MARKET CORRECTION -- The day after you buy stocks.

CASH FLOW -- The movement your money makes as it disappears down the toilet.

YAHOO -- What you yell after selling it to some poor sucker for $240 per share.

WINDOWS -- What you jump out of when you're the sucker who bought Yahoo @ $240 per share.

INSTITUTIONAL INVESTOR -- Past year investor who's now locked up in a nuthouse.

PROFIT -- An archaic word no longer in use.

Wonder who actually thought of this kind of stuff...lol

Thursday, November 13, 2008

PhillipCapital Market Watch 10-16 Nov

This is a video by Phillip securities giving their views on China

Summary :

- China heavily dependent on exports, hence with present economy slump, its economy will be affected

- They have lifted the credit quota of banks in China and hence encourage banks to lend more. This is a better way to boost lending than decreasing interest rates.

- Government trying to boost internal consumption in order to grow the economy

- This is done so by lowering the housing prices and medical care, as currently these are very high, indirectly casuing their citizens to save more and spend less

Wednesday, November 12, 2008

Credit Swaps

What are credit swaps? ( This word has been mentioned quite a lot of times in this financial crisis)

What are credit swaps? ( This word has been mentioned quite a lot of times in this financial crisis)Definition

Credit Default Swaps (CDS) is an insurance against a default of a bond. Where you can actually can own or not own that bond.

In short

It is something like paying an insurance premium to company A betting that company B will fall.

A scenario example will be : An investor like me pays company A $2 every year, because in the event company B fails, I will get $50. This premium drops when company B is supposedly reputable and reliable because it unlikely to fail.

However in the case of AIG ( company A) , because large reputable companies ( comapany B = Lehman Brothers etc.) fell, they had to pay these investors huge sums of money and hence was almost forced to bankruptcy.

Hope you all understand a little more about CDS now.. =)

Tuesday, November 11, 2008

General Motors and Circuit City file for bankruptcy

Just saw the news on Yahoo

Just saw the news on YahooGeneral Motors and Circuit City in the US have filed for bankruptcy. Both are big companies in the US..and I do expect more to be coming, especially the non-financial companies. Its time the effect actually hit these companies.

I could see the bankruptcy of Circuit City coming as I was in the US at the start of the year for a school exchange program.

The reason I went to visit Circuit City was because a US friend of mine was buying a new laptop. When I was visiting the shop ,I was shocked. Because :

- The 1 storey building is huge, around 1/2 a soccer field, bigger than any Singapore electronics shop

- The number of Plasma TVs, Home theater system is really crazy, imagine the amount of power it uses

- BUT, there was less than 10 customers in the shop, and it was at around 7-8pm, essentially many many more staff than customers

- Customer service was really bad. We spent like 1/2 hr waiting for the sales assistant to get the laptop from the storeroom. Worst still, we had to spend a full 15min waiting at the counter before the person actually attended to us. Considering the fact that there were MANY other staff personal around the counter, but just not behind the counter

- Things in general are more expensive than eBay,amazon and other online shops. According to my friend, US consumers are shifting towards eShopping so its inevitable such shops will have to close down soon..

What happens in the Stock Market? =)

Monday, November 10, 2008

OCBC Bank Christmas Promotion

Charge at least :

$5000 - Free iPod Nano

$2000 - Free Premium Lafite Wine Set

$500 - Free Sasha's Bears

Original receipts must be presented to the redemption booths at Suntec City or Shaw House between 1 Nov 2008 – 31 Dec 2008.

More info at http://www.ocbc.com/personal-banking/promotion/xmas2008.shtm

Sunday, November 9, 2008

Shifting all Technical analysis to new web page

The link is : http://thepowertotrade.blogspot.com/

Condominum up for rent

I have decided to offering $1000 to anyone who can successfully recommend a tenant for 12months. And $2000 if the tenant stays for 2 years. =)

Saturday, November 8, 2008

Standard Chartered e$saver ( Updated 1st Dec 2008)

| Deposit Balance | New interest rates from 4 August 2008 |

| Less than S$50,000 | 0.50% p.a. |

| S$50,000 to S$199,999 | 0.88% p.a. |

| S$200,000 & above | 1.00% p.a. |

No catch! Its a good 'normal savings account'

Advantage

- Good interest rate!

- No lock in period, you can withdraw the money any time you want

- For below $50,000 its better than Maybank's Isavvy

- No bank book, everything is done online

- Cannot draw money over the counter, but if you want they will charge $5

- Maximum internet bank transfer of $10,000 per day. But i guess this is a lot for most people

- For above $50,000 Maybank's Isavvy is better

More information can be found at : http://www.standardchartered.com.sg/

Promotion ( Till 31 Dec 2008 )

For more info : http://www.standardchartered.com.sg/deposits/esaver_bonus_interest/index.html

Friday, November 7, 2008

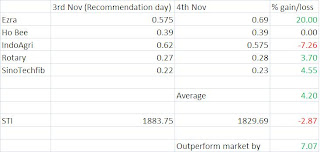

Week review of stock picks

In general, my stock picks outperformed the market by 9.53% for this week.

However, this is not truly the way I would trade, as i realized that my trading decisions do vary daily, as the charts changes. Hence I would not have held on to all the stocks for the whole week, and most probably would have taken profit at sometime in the week and stayed out out of the market, because I was uncertain.

I decided to set up another blog, www.ThePowerToTrade.blogspot.com . This is because I would like to keep the present www.ntuchartist.blogspot.com as a blog solely for good deals and financial stuff. And the other blog solely for stock picks and simulation for paper trading.

Have a good week end to all!

Idea for making a quick buck! (using the Manhattan Platinum Card)

The Standard Charted Manhattan Platinum offers quite a lot of perks such as

- Credit limit of up to 4X monthly salary

- 0% interest free purchase for up to 24mth from participating merchants

- Interest rate that can drop down to 12% a year compared to 24% of others

- Cash rebates that varies according to how much you use a month. Up to 5% for $3000 spending a month, ( capped at $300 a quarter)

Basic idea:

We are to buy and sell something and pocket the 5%. And this 'thing' has to be very liquid and will depreciate very little in that short span.

One possible plan ( using the stock market) :

- Buy 6 lot of share at $1 each (which is the selling price) each=> pay $6000

- Immediately sell it into the buying price, which is lower, say $0.99. Hence you get back $5940.

- Including transaction charges ( around $70) and loss due to step 1 and 2, you would have lost $70 + ( $6000-$5940) = $130

- However due to the rebate of 5% of $6000, you get back $300.

- Hence total profit is $300-$130= $170

Any comments/ideas ..feel free to email me at ntuchartist@hotmail.com

Thursday, November 6, 2008

Daily Review of stock pick

( click on picture to maximize)

( click on picture to maximize)Despite the drop in today's market.. the overall stock picks is still better than the market. However, I would have sold all the stocks yesterday, because I would rather not trader on a bad STI day, as it might affect all the other stocks.

Looking at the charts again, I would think

Ezra still has upside ( around 0.85 )

Ho Bee, uncertain, would not trade

IndoAgri, don't look good, will not trade

Rotary, if it trades above 0.29 tmr, can consider

SinoTechFib, a little more uspide, ( around 0.23 )

*Disclaimer : What ever appears on the blog is for your own reference only. It is not an investment/trading advice. It is always best to consult your personal financial adviser before parting with your money.

Obama Won!

Dow Jones

I realized that I should have look at the charts of the Dow Jones yesterday (figure above,click to zoom in) before deciding to hold onto any stocks. This is because the chart of the Dow Jones shows that it will most likely not be able to rise, as it is nearing the top of the bollinger band, i.e. the top of the band forms a resistance..so ideally we should have closed all our positions yesterday.

STI

As for the STI, when it was closing yesterday, I also should have seen that the middle of the band could be set as a resistance, and hence positions should have been closed as I could not be sure of whether the resistance line could be broken or not.

In general

The Dow Jones has turned more bearish, however signs are not clear yet. ( That is why I feel that positions should be closed yesterday. Do not trade if you are not sure!) It has dropped below the MAs, however as long it does not drop below the center of the bollinger band, it still has a chance for a rebound.

The STI will most likely follow the Dow Jones, but if a rally were to occur, the jump might be bigger than that of the Dow Jones, as it is below the center of the bollinger band.

So give a day or too, let the post election stock market stabilize first before reading the signals again.

*I guess, it shows that daily monitoring before the end of the day is crucial to determining whether you should buy/sell your stocks for the next day..

Wednesday, November 5, 2008

Daily review of stock picks

( click on the picture to maximize it)

( click on the picture to maximize it)Looks like the stocks did not outperform the market today. However I did mention that the 2 stocks that are more likely to go up, Ezra and Rotary and they did not disappoint me. =)

Think I shall review the way I do my stock picks, including sell and buy target but will leave it for next week.

PhillipCapital Market Watch

Summary :

- Looking for bottom of STI of at least 1400-1800

- TA shows temporary bull market, but long term TA still bearish

- Bull market will return when companies outperform analysis's reports

Tuesday, November 4, 2008

Daily review of stock picks

Market dropping

Please do not trade base on this stock picks! These are only for trials...

*Disclaimer : What ever appears on the blog is for your own reference only. It is not an investment/trading advice. It is always best to consult your personal financial adviser before parting with your money.

Basic things you should know about Structured products

Many of you might have heard about the DBS High notes Series and Lehman Mini bond Series giving so much trouble as investors were 'bluffed' in to buying them, it is actually important to know what you are getting yourself into when you buy such structured products.

Here are some important things that you should know:

Structured products are packages of various investment strategies and ideas packaged into a single deal and sold to the people by financial institution.

These products can be sold through middlemen. For example Company A comes up with the product and Company B helps to sell it.

Capital Protected products are usually 'protected' by the instruments that are used.

For example, 85% of the of the product could be in bonds ( which are relatively low risk) and the rest of the 15% in higher risk products like stocks in order to give you a higher return.

Hence if anything major were to happen, at the the 85% of the products will still be there, limiting the downside loss.

However capital protected products only protect you from market risk and not credit risk. I.e if the company that comes up with the product ( company A) closes down, the investor losses everything.

Capital guaranteed means that your investment is guaranteed by a 3rd party and not by the person who is selling you, or the person that is issuing the product.

An example would be Company A sets up a structured product, and ask Company B to sell it. However this structured product is guaranteed by Company C. Hence as an investor who is buying from Company B, you should worry about whether Company C is credible enough to pay you, in the event Company A faces problems.

Usually such products have lower risk and lower returns because part of the product consists of 'insurance fees' paid to the guarantor( Company C)

These are the basics of structured product. However there are still MANY things that you should know, like what are the returns like and the other risks involved. I always believe that you should ask for the worst case scenario and judge how likely that it will happen before buying it. And if possible ask an unbiased financially savvy person on what he/she feels about the product. This should give you somewhat protection from being 'swindled' by the bank manger.

Stock picks done on 03 Nov 2008

I suggest keeping watch of these stocks. ( Inspired by a reader of this blog )

Will compare the returns of these stocks against the STI as a benchmark at the end of the week. ( Prices Quoted are the closing price on 3rd Nov 2008 )

- Ezra $0.575

- Ho Bee $0.39

- IndoAgri $0.62

- Rotary $0.27

- SinoTechfib $0.22

Due to a recent comment from one of the readers, I shall explain why I have chosen these counters.

- The market in general is still in the downtrend, hence these counter are not meant for 'long'

- However TA has shown that a rebound is in sight. Hence I am trying to find stocks that might outperform the STI in these rebound period using TA.

*Disclaimer : What ever appears on the blog is for your own reference only. It is not an investment/trading advice. It is always best to consult your personal financial adviser before parting with your money.

Monday, November 3, 2008

Drivers will love this!

Found a great site for all drivers !

This site has

- Latest pump prices all over Singapore

- Current petrol discounts for the different type of credit cards

- Locations of petrol stations

- Parking/cost of parking over Singapore

There is this other link that shows parking cost in Singapore too..

link: http://www.onemotoring.com.sg/publish/onemotoring/en/on_the_roads/parking/parking_rates.html

This is another link contributed by one of the readers of this blog.. ( thanks!)

: http://www.sgcarmart.com/news/carpark_index.php

Sunday, November 2, 2008

TA of STI for coming week (3-9 Nov 2008)

MACD: Bullish crossover soon

RSI: Has not reach to overbought yet, upside is still possible

Average True range ( ATR ): Divergence, Signaling a reversal is possible

Parabolic SAR ( Red circles ) : Intersect the price line, bullish

Moving Averages (MA) : 5 day MA still below 7 day MA,however rising

Bollinger Band: Price still in lower band, the centre of the band might act a s resistance.

In general : It seems like the trend for the STI is not as bullish as the Dow Jones however for the short term, it looks bullish enough. Lets see..

*Disclaimer : What ever appears on the blog is for your own reference only. It is not an investment/trading advice. It is always best to consult your personal financial adviser before parting with your money.

TA of Dow Jones for coming week (3-9 Nov 2008)

MACD: Bullish crossover

RSI: Has not reach to overbought yet, upside is still possible

Average True range ( ATR ): Divergence, Signaling a reversal is possible

Parabolic SAR ( Red circles ) : Intersect the price line, bullish

Moving Averages (MA) : 5 day MA cut above 7 day MA

Bollinger Band: Price went pass the center of the band, bullish

In general : It seems like the trend for the Dow Jones is going to be bullish for the week. Lets see..

*Disclaimer : What ever appears on the blog is for your own reference only. It is not an investment/trading advice. It is always best to consult your personal financial adviser before parting with your money.

Saturday, November 1, 2008

HSBC Giving Away Free* Olympus digital camera

More about the promotion:

HSBC is giving away 2,000 Olympus digital camera*, just so you can capture all those priceless moments! All you have to do is spend a minimum of S$3,000 on your HSBC credit card from 1 November to 31 December 2008 and simply SMS in between 5 January 2009, 9am and 11 January 2009, 11.59pm to redeem this festive giveaway.

However!!

Under the terms and conditions, one of the clause is :

Eligible purchases include retail purchases, online and foreign purchases, cash advance and recurring payment for 0% IPP; excluding cash advance, fund transfers, financial charges, late charges, fees, tax payments and outstanding balances.

Apparently i think they made a typo here, because for the other credit cards, cash advance is allowed as an 'eligible purchase'

Therefore..i was thinking...what if you made a cash advance of $3000 and return it back as soon as possible. Incurring only the cash advance fee of 5%, which is $150, means you ideally pay $150 for the camera.

However if you are going to spend $3000 over the Christmas season anyway, then forgot about trying to use the cash advance method to chalk up a spending of $3000..

Camera info: http://www.olympusimage.com.sg/products/compact/fe_series/fe360/

Camera info: http://www.olympusimage.com.sg/products/compact/fe_series/fe360/Rough worth of camera : http://cgi.ebay.com.sg/Olympus-fe360-FOC-gifts-for-sale_W0QQcmdZViewItemQQitemZ320310837706

Jewellery Auction !! ( on 2nd Nov 2008 )

The Singapore Police is auctioning off recovered assets from credit card frauds and other consignments.

This is a good chance for you to get cheaper than market price jewellery!

Details as follows :

| Date |

| Sunday, 2 November 2008 |

| Venue |

| Hilton Hotel Singapore |

| Address |

| Panorama Room Level 24, 581 Orchard Road SINGAPORE |

| Viewing |

| Sunday 2 November 2008 11am - 1pm |

| Auction Starts |

| Sunday 2 November 1pm Complimentary Refreshments. For further information please call 6232 2744. Catalogue descriptions are guaranteed. 15% Buyers Premium Applies. |

Link to webby : http://www.firststateauctions.com/auction.asp?WEB_Code=2510